One of the important issues discussed in a previous post, Salary Curve, is how to make savings last beyond retirement. This is obviously tied to how much the income earner (and spouse) is expected to live post retirement. If the subjects leave this world five years after retirement, most likely their savings will last till the end.

But for Indians, the equation has changed dramatically within the last few generations.

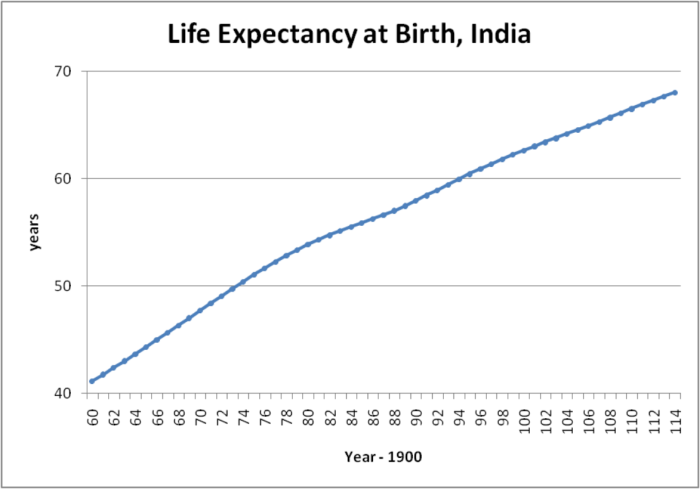

Let us look at some world bank data for India [1] for life expectancy at birth.

The trend is quite consistent. Life expectancy is seen to increase by one year every two years – that is, by 10 years every generation (20 years [2]). Life expectancy in many European nations was about 80-82 years in 2014, compared to 68 years for India. This leads me to expect that the upward trend in the graph is likely to continue for another decade, although the rate of increase has already tapered off to one year every 2.5 years.

One can draw some disturbing conclusions from this data:

- A person can expect a life expectancy to be higher by about 10-20 years compared to his parents and grandparents. Financial planning will therefore be different than what was needed by parents and grandparents

- Increasing life expectancy means a larger burden being placed on future generations – having to take care of grandparents as well as parents. And who knows, maybe great-grandparents too.

[1] Life Expectancy data

[2] Generation gap

[…] should be clear from the previous posts, especially the ones titled Salary Curve, Life Expectancy, and Middle Class Saving Mantras, almost all of us middle class people are squarely in a salary […]

LikeLike